Do you have difficulty creating a winning resume for a student loan advisor job?

Many have the same issue because of the lack of online information about this role.

Luckily, this post will make writing your student loan advisor resume a breeze. We’ll provide you with robust resume examples to use.

We’ll also teach you how to customize these examples to reflect your skills and boost your chances of landing the job.

Student Loan Advisor Resume Examples

Whether you’re an entry-level or senior student loan advisor, you need to show your knowledge in managing finances in your resume.

You also have to highlight your ability to communicate with a diverse audience.

Depending on your level of experience, there are other soft and technical skills you should demonstrate. Here’s how you can showcase your abilities in the resume:

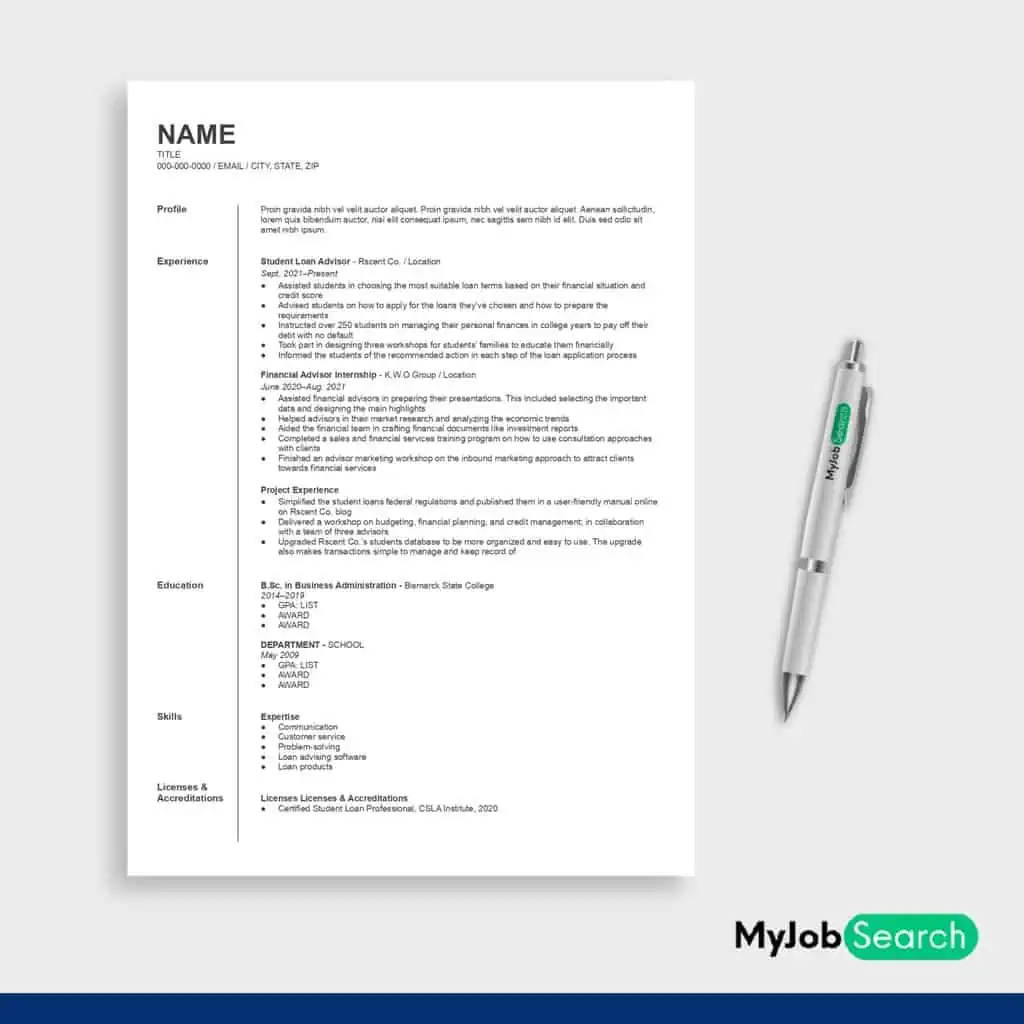

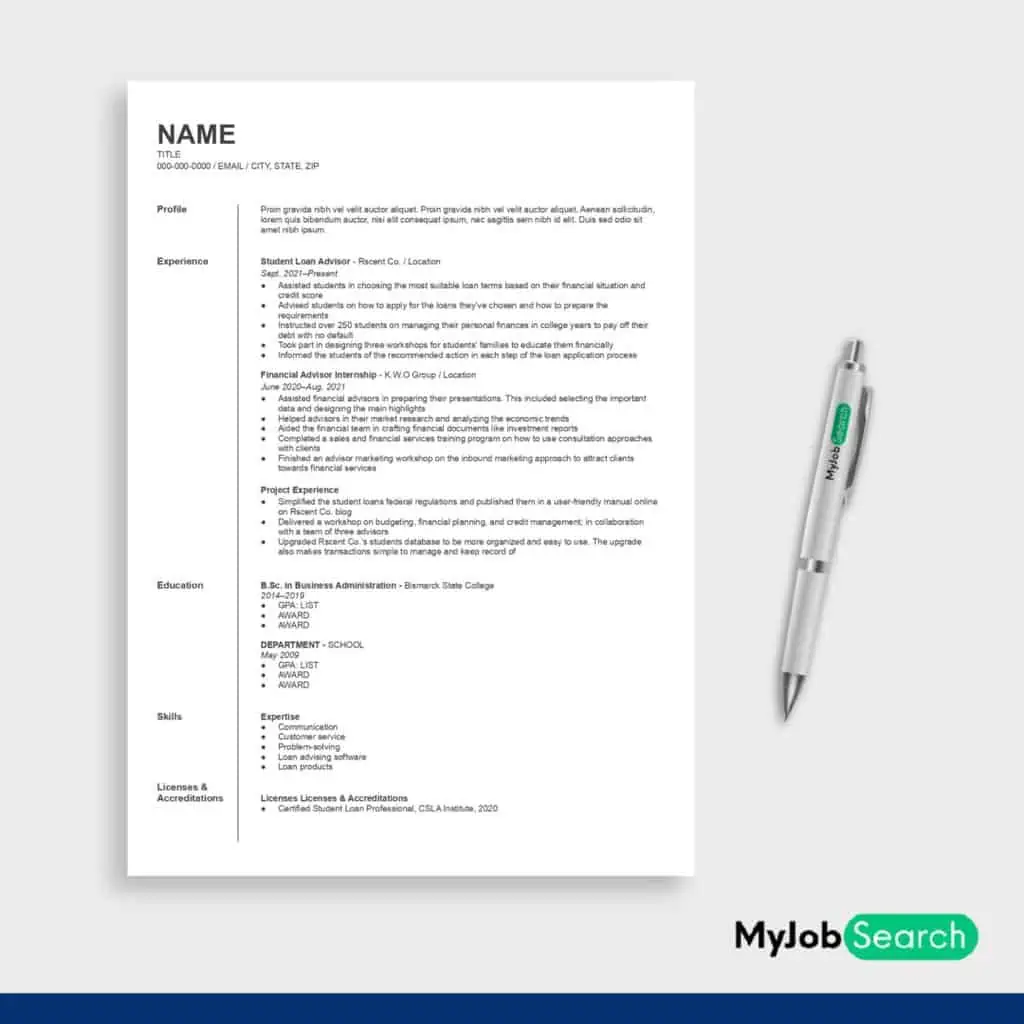

Entry-Level Student Loan Advisor Resume Example

Why We Suggest this Resume

An entry-level student loan advisor needs to have a basic knowledge of the student loan market. This resume illustrates to the employer that the applicant has experience in assisting students with their financial decisions.

- Type of Resume: Entry-Level Student Loan Advisor Resume

- Best For: Those applying for entry-level student loan advisor jobs

If you’re new to the field of student loan consultation, you need only a few months of experience to land a junior position.

An entry-level vacancy typically requires from 6 to 12 months of experience.

This short period of experience proves you have a strong understanding of student loans and can work smoothly on the lending process.

Here’s an example of an entry-level student loan advisor resume:

Work Experience 1

Student Loan Advisor, Rscent Co.: Sept. 2021–Present

- Assisted students in choosing the most suitable loan terms based on their financial situation and credit score

- Advised students on how to apply for the loans they’ve chosen and how to prepare the requirements

- Instructed over 250 students on managing their personal finances in college years to pay off their debt with no default

- Took part in designing three workshops for students’ families to educate them financially

- Informed the students of the recommended action in each step of the loan application process

Work Experience 2

Financial Advisor Internship, K.W.O Group: June 2020–Aug. 2021

- Assisted financial advisors in preparing their presentations. This included selecting the important data and designing the main highlights

- Helped advisors in their market research and analyzing the economic trends

- Aided the financial team in crafting financial documents like investment reports

- Completed a sales and financial services training program on how to use consultation approaches with clients

- Finished an advisor marketing workshop on the inbound marketing approach to attract clients towards financial services

Project Experience

- Simplified the student loans federal regulations and published them in a user-friendly manual online on Rscent Co. blog

- Delivered a workshop on budgeting, financial planning, and credit management; in collaboration with a team of three advisors

- Upgraded Rscent Co.’s students database to be more organized and easy to use. The upgrade also makes transactions simple to manage and keep record of

Skills

- Communication

- Customer service

- Problem-solving

- Loan advising software

- Loan products

Education

B.Sc. in Business Administration, Bismarck State College, 2014–2019

Licenses & Accreditations

Certified Student Loan Professional, CSLA Institute, 2020

Why This Resume Works

An entry-level student loan advisor needs to have a basic knowledge of the student loan market. They also need decent experience in financial consultation careers.

The resume illustrates to the employer that you have experience assisting students with their financial decisions. The listed internship and the full-time job showcase this.

A high-performing loan consultant needs to have excellent communication and customer support skills too. These competencies are at the top of the skill set list on the resume.

The business degree in the education section also demonstrates an understanding of finance principles.

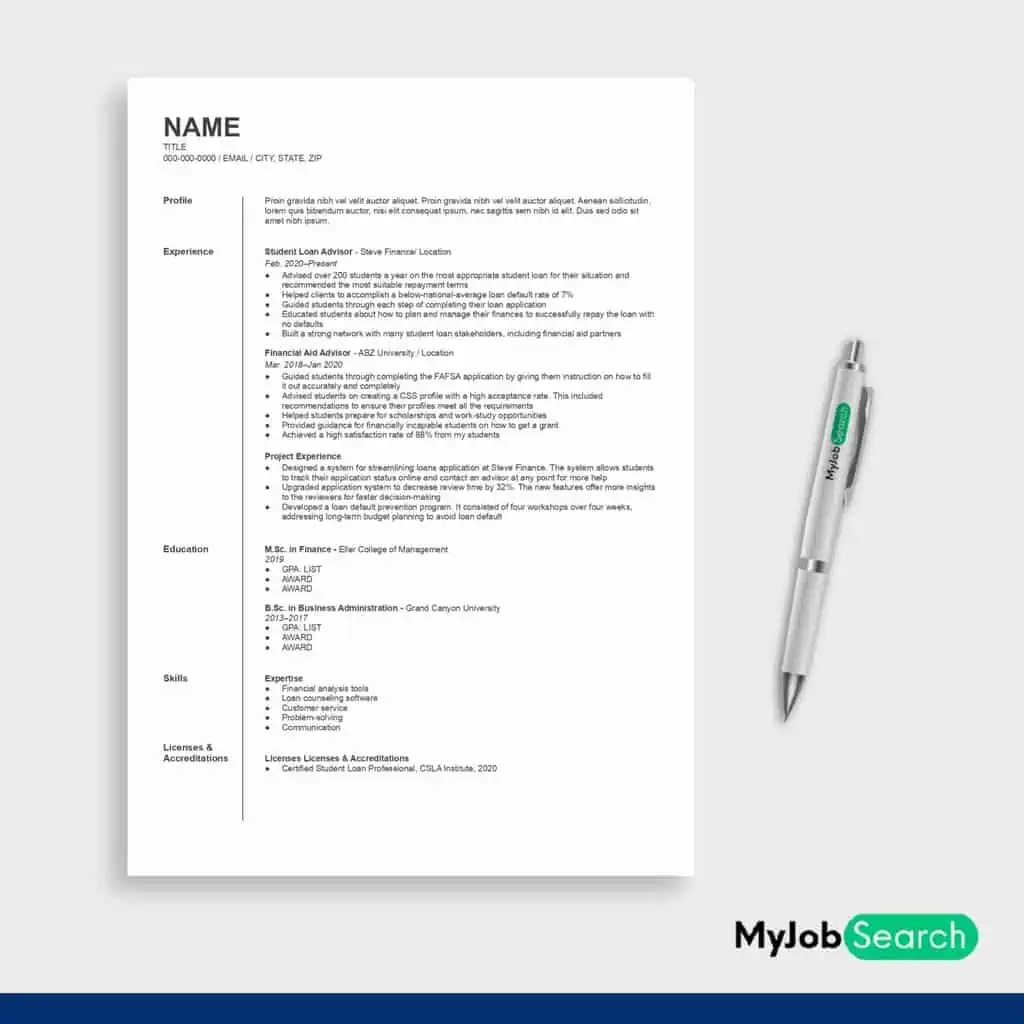

Mid-Level Student Loan Advisor Resume Example

Why We Suggest this Resume

A mid-level student loan advisor needs to have a proven record of success as a financial consultant. As such, this resume sheds light on the applicant's achievements as an advisor.

- Type of Resume: Mid-Level Student Loan Advisor Resume

- Best For: Those with a minimum of three years of financial advising experience

As a mid-level student loan consultant, an employer expects you to have a minimum of three years of financial advising experience.

You need to be skillful in using loan counseling and financial analysis software programs. If your financial experience is related to student loans, that’d be a significant advantage.

Communication and problem-solving abilities are required for this role as well.

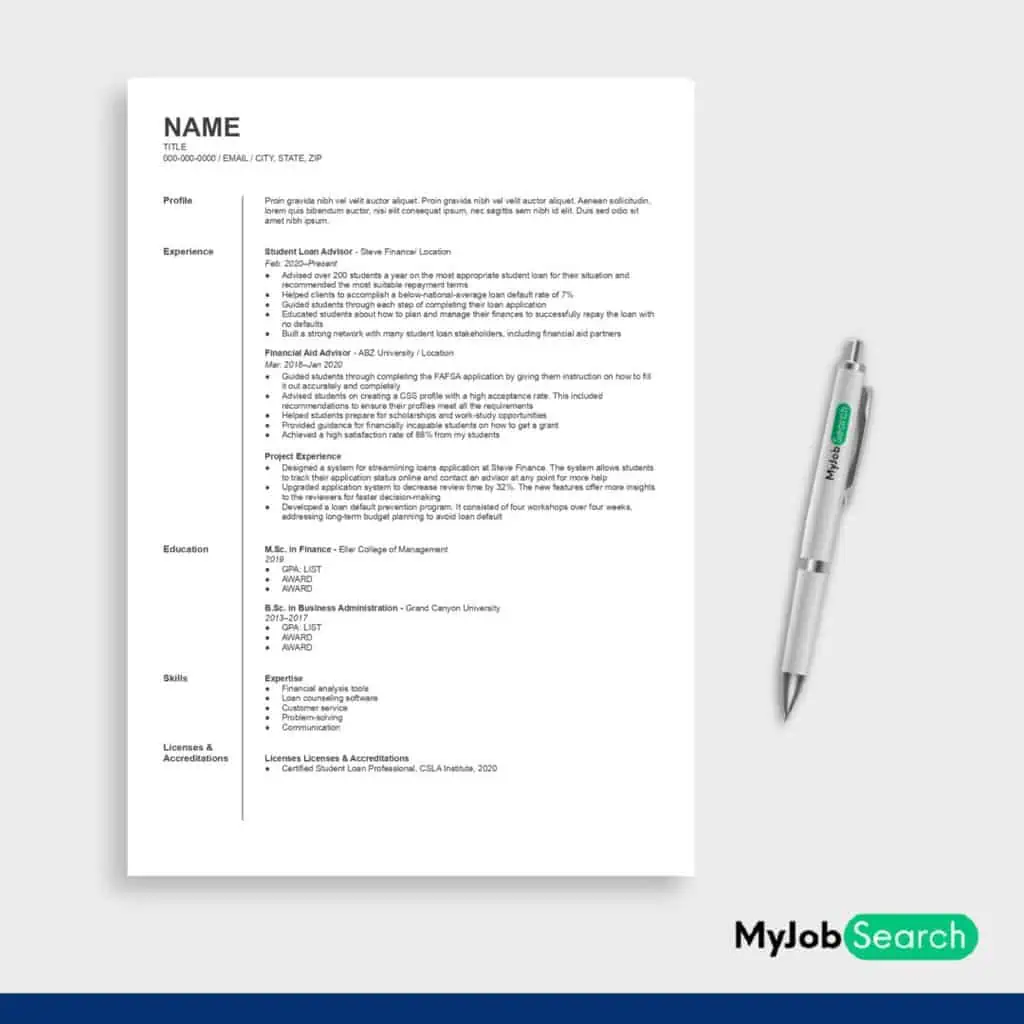

Here’s an example of a mid-level student loan advisor resume:

Work Experience 1

Student Loan Advisor, Steve Finance: Feb. 2020–Present

- Advised over 200 students a year on the most appropriate student loan for their situation and recommended the most suitable repayment terms

- Helped clients to accomplish a below-national-average loan default rate of 7%

- Guided students through each step of completing their loan application

- Educated students about how to plan and manage their finances to successfully repay the loan with no defaults

- Built a strong network with many student loan stakeholders, including financial aid partners

Work Experience 2

Financial Aid Advisor, ABZ University: Mar. 2018–Jan 2020

- Guided students through completing the FAFSA application by giving them instruction on how to fill it out accurately and completely

- Advised students on creating a CSS profile with a high acceptance rate. This included recommendations to ensure their profiles meet all the requirements

- Helped students prepare for scholarships and work-study opportunities

- Provided guidance for financially incapable students on how to get a grant

- Achieved a high satisfaction rate of 88% from my students

Project Experience

- Designed a system for streamlining loans application at Steve Finance. The system allows students to track their application status online and contact an advisor at any point for more help

- Upgraded application system to decrease review time by 32%. The new features offer more insights to the reviewers for faster decision-making

- Developed a loan default prevention program. It consisted of four workshops over four weeks, addressing long-term budget planning to avoid loan default

Skills

- Financial analysis tools

- Loan counseling software

- Customer service

- Problem-solving

- Communication

Education

- M.Sc. in Finance, Eller College of Management, 2019

- B.Sc. in Business Administration, Grand Canyon University, 2013–2017

Licenses & Accreditations

Certified Student Loan Professional, CSLA Institute, 2020

Why This Resume Works

A mid-level student loan advisor needs to have a proven record of success as a financial consultant. As such, this resume sheds light on your achievements as an advisor. It illustrates the numbers you’ve reached.

Because student loan terms differ from other loan types, you have to be knowledgeable about federal and private student loans. Adding student loan professional certification proves your knowledge in this area.

The resume also emphasizes two critical skills for any financial advisor: proficiency in using financial analysis and loan counseling tools.

The listed soft skills showcase your communication and customer service abilities.

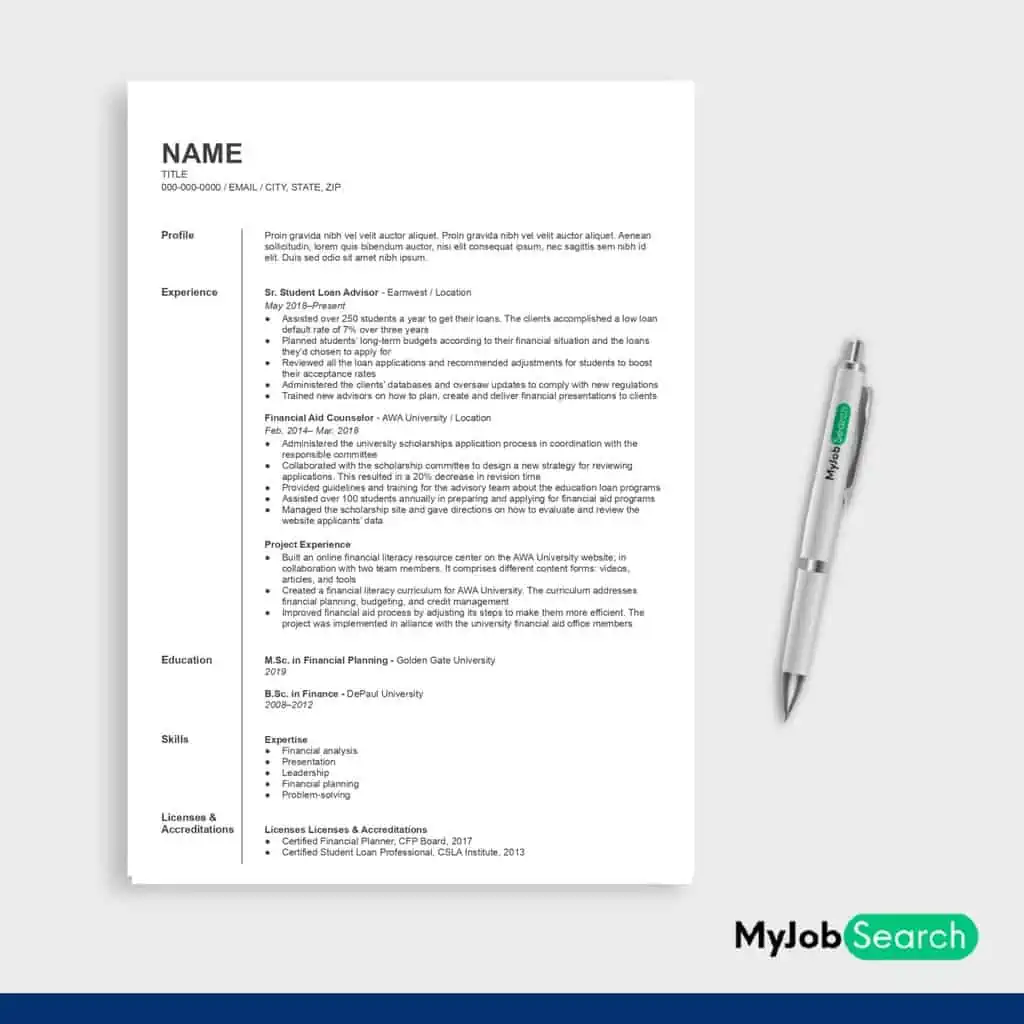

Senior Student Loan Advisor Resume Example

Why We Suggest this Resume

This resume is great because it exhibits significant experience and achievements of the applicant in finance-related positions. It also includes the number of issued loans and the default rate of the clients.

- Type of Resume: Senior Student Loan Advisor Resume

- Best For: Those with at least five to seven years of experience working on loan consultation projects

A senior advisor needs to be capable of leading and mentoring a team of advisors to help students with financial aid.

To be an outstanding senior financial counselor, you should demonstrate proficiency in strategic financial planning and problem-solving.

You also need at least five to seven years of experience working on loan consultation projects.

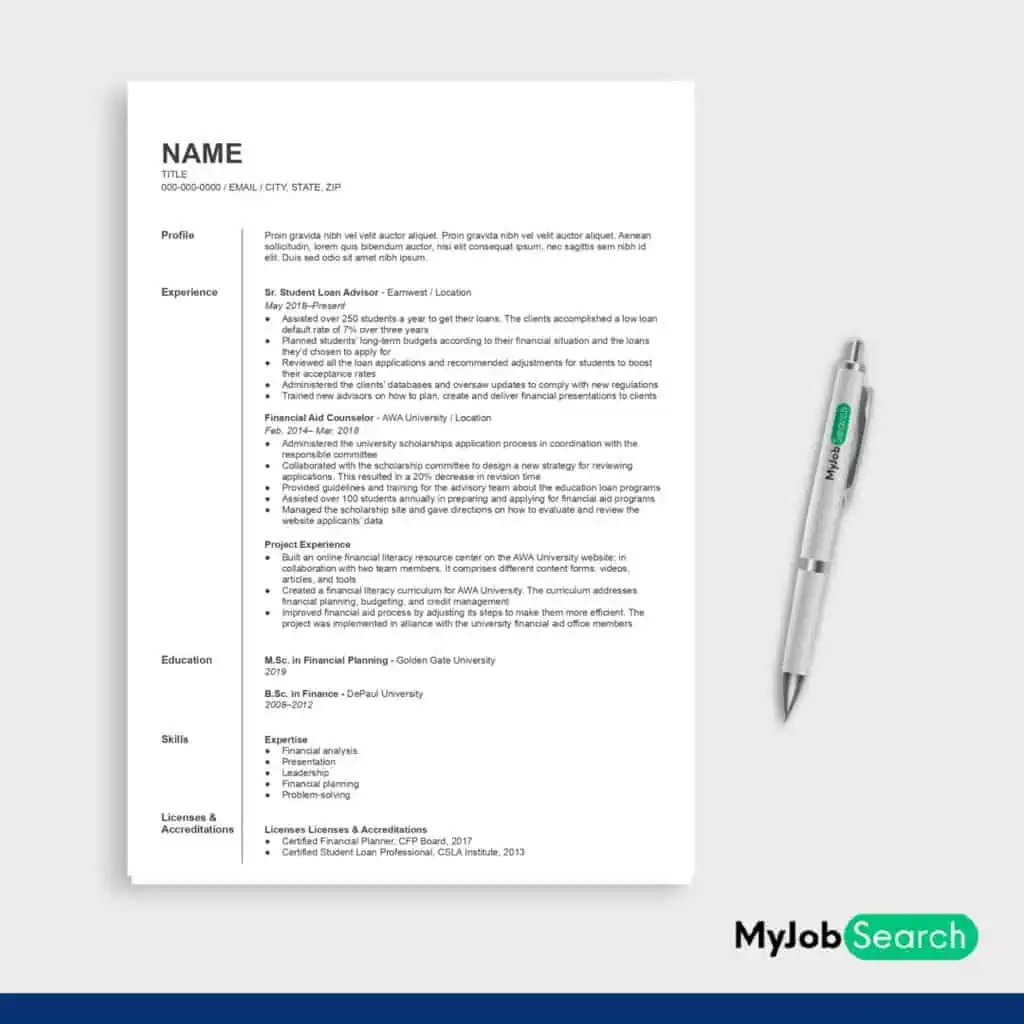

Here’s an example of a senior student loan advisor resume:

Work Experience 1

Sr. Student Loan Advisor, Earnwest: May 2018–Present

- Assisted over 250 students a year to get their loans. The clients accomplished a low loan default rate of 7% over three years

- Planned students’ long-term budgets according to their financial situation and the loans they’d chosen to apply for

- Reviewed all the loan applications and recommended adjustments for students to boost their acceptance rates

- Administered the clients’ databases and oversaw updates to comply with new regulations

- Trained new advisors on how to plan, create and deliver financial presentations to clients

Work Experience 2

Financial Aid Counselor, AWA University: Feb. 2014– Mar. 2018

- Administered the university scholarships application process in coordination with the responsible committee

- Collaborated with the scholarship committee to design a new strategy for reviewing applications. This resulted in a 20% decrease in revision time

- Provided guidelines and training for the advisory team about the education loan programs

- Assisted over 100 students annually in preparing and applying for financial aid programs

- Managed the scholarship site and gave directions on how to evaluate and review the website applicants’ data

Project Experience

- Built an online financial literacy resource center on the AWA University website; in collaboration with two team members. It comprises different content forms: videos, articles, and tools

- Created a financial literacy curriculum for AWA University. The curriculum addresses financial planning, budgeting, and credit management

- Improved financial aid process by adjusting its steps to make them more efficient. The project was implemented in alliance with the university financial aid office members

Skills

- Financial analysis

- Presentation

- Leadership

- Financial planning

- Problem-solving

Education

- M.Sc. in Financial Planning, Golden Gate University, 2019

- B.Sc. in Finance, DePaul University, 2008–2012

Licenses & Accreditations

- Certified Financial Planner, CFP Board, 2017

- Certified Student Loan Professional, CSLA Institute, 2013

Why This Resume Works

A senior student loan advisor needs to have a broad experience in finance-related positions to understand their client’s financial challenges.

They’ll also be able to direct their team based on their expertise. A solid financial planning skill will help in this role, as you’re responsible for mapping out your client’s long-term budgets.

You’ll review your team members’ plans for the clients to ensure they’re mistakes-free as well.

Presentation skills for seniors are vital because they’ll allow you to instruct your team and clients effectively.

The resume does an excellent job of showing all these skills. It highlights significant achievements, too. This includes the number of issued loans and the default rate of the clients.

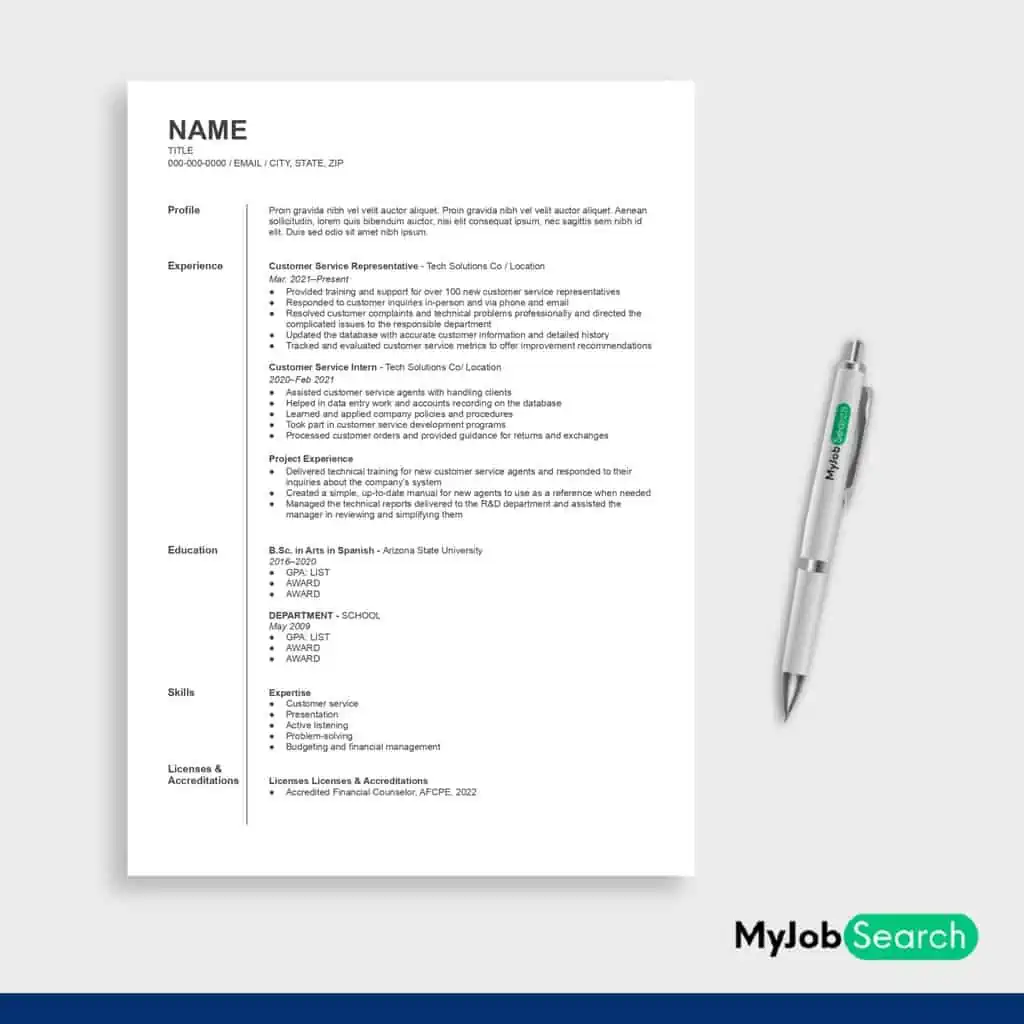

Financial Literacy Specialist Resume Example

Why We Suggest this Resume

This resume is excellent because it shows multiple transferable skills valuable to a financial literacy specialist position. Additionally, it showcases your ability to instruct others, which is helpful for this role.

- Type of Resume: Financial Literacy Specialist Resume

- Best For: Those applying for financial literacy specialist jobs

A financial literacy specialist is still a student loan advisor, but their responsibilities differ from a regular advisor in some areas.

They focus more on educating student groups and managing their finances, rather than giving one-to-one consultations. However, they can do both.

These specialists conduct regular orientations, information booths, and workshops for financial education.

A communicative personality and the ability to answer inquiries efficiently are essential for this role. Public speaking is also one of the main requirements.

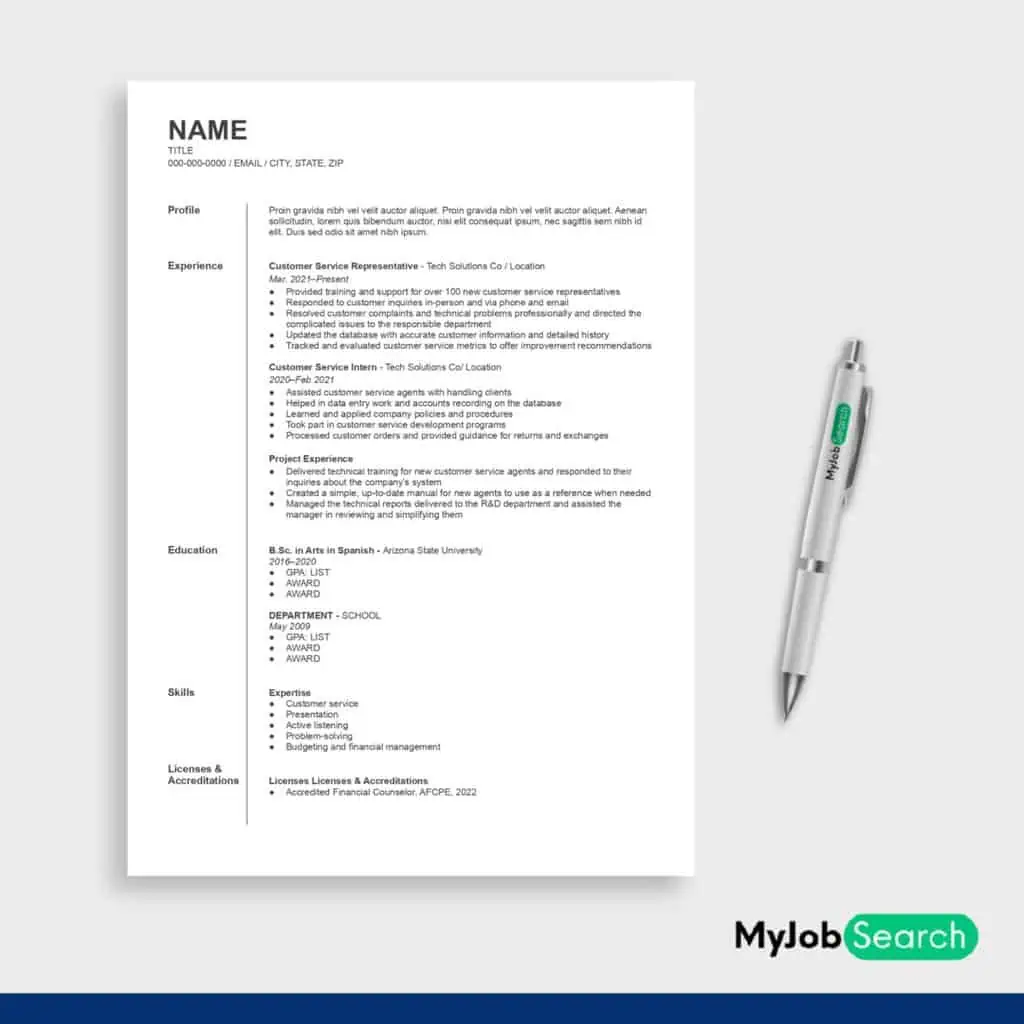

Here’s an example of a financial literacy specialist’s resume:

Work Experience 1

Customer Service Representative, Tech Solutions Co: Mar. 2021–Present

- Provided training and support for over 100 new customer service representatives

- Responded to customer inquiries in-person and via phone and email

- Resolved customer complaints and technical problems professionally and directed the complicated issues to the responsible department

- Updated the database with accurate customer information and detailed history

- Tracked and evaluated customer service metrics to offer improvement recommendations

Work Experience 2

Customer Service Intern, Tech Solutions Co: Nov. 2020–Feb 2021

- Assisted customer service agents with handling clients

- Helped in data entry work and accounts recording on the database

- Learned and applied company policies and procedures

- Took part in customer service development programs

- Processed customer orders and provided guidance for returns and exchanges

Project Experience

- Delivered technical training for new customer service agents and responded to their inquiries about the company’s system

- Created a simple, up-to-date manual for new agents to use as a reference when needed

- Managed the technical reports delivered to the R&D department and assisted the manager in reviewing and simplifying them

Skills

- Customer service

- Presentation

- Active listening

- Problem-solving

- Budgeting and financial management

Education

B.Sc. in Arts in Spanish, Arizona State University, 2016–2020

Licenses & Accreditations

Accredited Financial Counselor, AFCPE, 2022

Why This Resume Works

Although the resume doesn’t contain a direct finance-related position, it shows multiple transferable skills valuable to a financial literacy specialist position.

Effective delivery of information comes on top of these skills. Additionally, it showcases your ability to instruct others, which is helpful for your desired role.

Your proficiency in handling customers, answering their inquiries, and solving their problems is appreciated for this financial role as well.

As you’re new to financial roles, you need to show your knowledge of the field. That’s why the resume contains the Accredited Financial Counselor certificate.

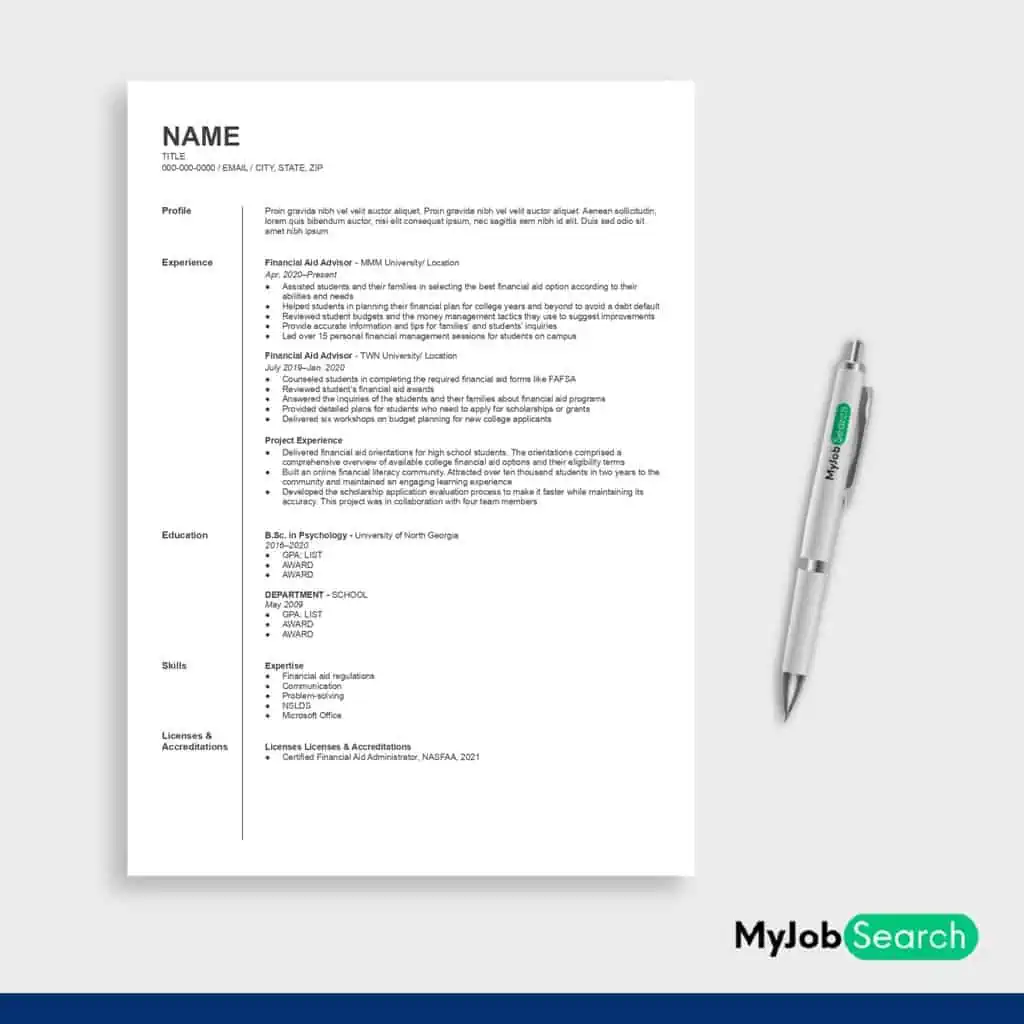

Financial Aid Advisor Resume Example

Why We Suggest this Resume

This resume showcases relevant work experience in financial aid advisory. It also highlights the initiative of the applicant in conducting multiple orientation sessions to educate high school students about financial aid options.

- Type of Resume: Financial Aid Advisor Resume

- Best For: Those applying for the financial aid advisor roles

As a financial aid advisor, you assist students in applying for financial aid programs to pay for college.

This includes providing the guidelines for submitting applications for grants, scholarships, or work-study jobs.

You’ll need a solid understanding of FAFSA applications and other similar aid options. You’ll also need to be familiar with financial planning strategies and how to use them to help the applicant students.

Effective communication and understanding of financial analysis have to be at the top of your skills.

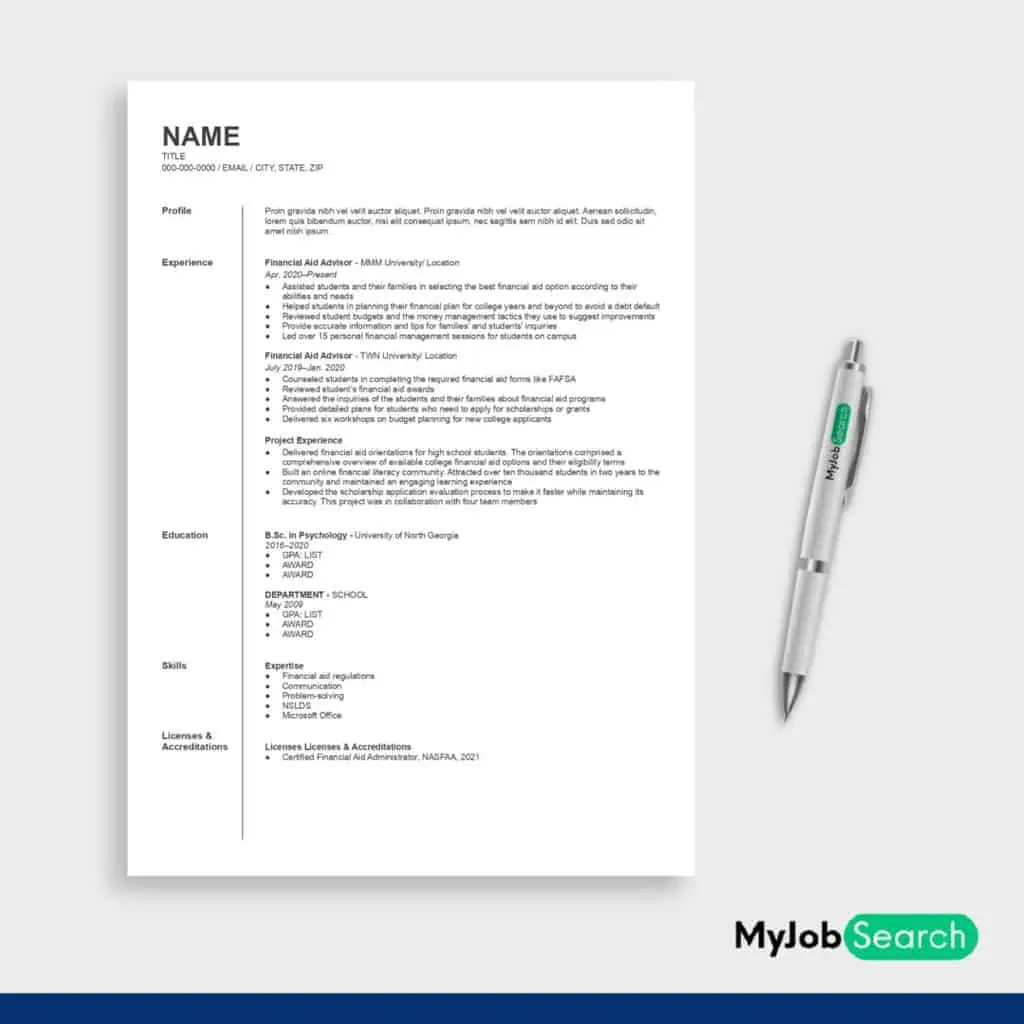

Here’s an example of a finance aid advisor’s resume:

Work Experience 1

Financial Aid Advisor, MMM University: Apr. 2020–Present

- Assisted students and their families in selecting the best financial aid option according to their abilities and needs

- Helped students in planning their financial plan for college years and beyond to avoid a debt default

- Reviewed student budgets and the money management tactics they use to suggest improvements

- Provide accurate information and tips for families’ and students’ inquiries

- Led over 15 personal financial management sessions for students on campus

Work Experience 2

Financial Aid Advisor, TWN University: July 2019–Jan. 2020

- Counseled students in completing the required financial aid forms like FAFSA

- Reviewed student’s financial aid awards

- Answered the inquiries of the students and their families about financial aid programs

- Provided detailed plans for students who need to apply for scholarships or grants

- Delivered six workshops on budget planning for new college applicants

Project Experience

- Delivered financial aid orientations for high school students. The orientations comprised a comprehensive overview of available college financial aid options and their eligibility terms

- Built an online financial literacy community. Attracted over ten thousand students in two years to the community and maintained an engaging learning experience

- Developed the scholarship application evaluation process to make it faster while maintaining its accuracy. This project was in collaboration with four team members

Skills

- Financial aid regulations

- Communication

- Problem-solving

- NSLDS

- Microsoft Office

Education

B.Sc. in Psychology, University of North Georgia, 2016–2020

Licenses & Accreditations

Certified Financial Aid Administrator, NASFAA, 2021

Why This Resume Works

The resume showcases relevant work experience in financial aid advisory. It indicates that you’ve performed all the key tasks of this role.

It also highlights your initiative in conducting multiple orientation sessions to educate high school students about financial aid options.

The Financial Aid Administrator certificate demonstrates your solid understanding of your job and all its responsibilities as well.

Common Skills & Action Verbs to Include on a Student Loan Advisor Resume

Because you directly communicate with students in this role, your soft skills are as necessary as your technical ones. You’re a problem solver in the first place, as students seek your help.

Strong financial planning skills are a must as you assist students and their families in mapping out their finances. You also have to embrace integrity and professional ethics to maintain your students’ trust.

Use the following list of skills and action verbs to reflect these important aspects about you. Keep in mind the ideal amount of skills to list.

Common Skills of a Student Loan Advisor

Here are the must-have technical and soft skills for any student loan advisor:

- Student loan counseling

- Budgeting and financial management

- Knowledge of financial aid regulations

- FAFSA

- Student loans

- Financial aid applications

- NSLDS

- Debt management

- Inbound calls

- Payment arrangements

- Loan servicing software

- Customer service

- Communication

- Problem-solving

- Analytical thinking

- Time management

- Presentation skills

Common Action Verbs for Student Loan Advisor Resumes

The verbs you use in describing your responsibilities and achievements can leave a good or bad impression about you.

You need to use verbs that convey professionalism and a solid understanding of your job responsibilities.

To make your resume stand out, use this effective list of action verbs as a guide:

- Developed

- Educated

- Assisted

- Counseled

- Advised

- Guided

- Helped

- Trained

- Provided

- Planned

- Communicated

- Resolved

- Supported

- Reviewed

- Managed

Tips for Writing a Better Student Loan Advisor Resume

Writing a good resume is one thing, but writing a winning one is another. Optimizing your resume can skyrocket your chances of getting the job you’re applying for.

Here’s how to write your ideal student loan advisor resume:

Use Numbers to Highlight Achievements

Quantifying your achievement using numbers and statistics is a powerful way to outweigh other applicants’ resumes.

For example, stating that you’ve helped over 90% of your clients avoid loan default proves that you have an exceptional advising history.

This is especially important for advisors of middle level and above. Any institute would like to hire someone with a high-performance record like this.

The more specific your numbers and the timeframe of the achievements is, the more credible you’ll appear to the recruiter.

Use Keywords Strategically

Most employers use ATS systems in the initial process of filtering resumes. These systems determine each resume’s strength based on its related keywords.

To pass this auto-filtration phase, use keywords highly relevant to the vacancy you’re applying for in your resume.

You’ll find the ideal keywords you need to use in the job description. Analyze the description thoroughly and pick the important keywords it contains.

The common skills and action verbs of the job are also powerful keywords. Place these keywords naturally within your resume content to optimize it for ATS systems.

Prove You Understand Finance

You can land a student loan advisor position without a finance or business degree or prior financial work experience.

However, no one will hire a financial advisor that doesn’t have some idea about finance. In these cases, you need to prove you have a good understanding of finance.

You can demonstrate that by listing a financial certificate in your resume, like the Student Loan Professional Certificate.

Customize Your Resume for the Job

Student Loan advisory jobs have similar responsibilities. However, each vacancy prioritizes specific responsibilities over others.

Read the job description and determine which skills and tasks are most important for the employer. Then, match the resume order with your findings.

You need to convey to the hiring manager that you’re the ideal candidate for their vacancy.

To do that, organize your resume to highlight the skills that the employer values most prominently.

Keep Your Resume Scannable

Recruiters review each resume for only a few seconds to decide whether it’s worth further consideration.

In this short time, you need to make a strong impression on the hiring manager by keeping your resume scannable.

Here are a few tips to make it easy to read:

- Make the headings clear

- Sort the responsibilities in bullet points

- Start sentences with action verbs

- Separate sections from each other and leave decent white space

- Use a simple font style and an appropriate font size

Triple-Check Your Resume

Triple-check your resume before submitting it to a recruiter. This is to ensure there are no spelling mistakes or grammatical errors. You can use proofreading tools to help you with that.

You also need to review the verbs you’ve used and make sure they convey the meanings you want to deliver.

As a financial advisor, you should be detail-oriented. This is to plan your clients’ budgets and track their progress in the application process.

Any errors in your resume will make the recruiter feel you’ll miss important job details.

Here are similar tips we’d give for an interview.

Frequently Asked Questions

What Is a Good Example of a Student Loan Advisor’s Resume Objective?

When writing your objective, refer to your communication, customer service, and problem-solving skills. You should also mention your solid financial planning skills.

Ultimately, tell the recruiter how you’ll use these skills to assist students in navigating the loan application process. Give them an idea of how this will benefit their business as well.

How Long Should a Student Loan Advisor’s Resume Be?

For an entry or mid-level advisor, the resume should be one page. A senior-level resume can be two or three pages.

In all cases, you have to be concise and relevant. Avoid including outdated or irrelevant information, as this will weaken your resume.

Do I Need to Include My GPA on My Student Loan Advisor’s Resume?

Including your GPA in your student loan advisor resume isn’t required. This is especially true if your degree isn’t related to the field.

Adding your GPA can be valuable only if you’re a recent finance major graduate with a high academic record.

Similar Resume Types to Reference

Applying for a student loan advisor internship to gain experience is a great way to kick off your career in case you’re new to the field.

You can also use student resume examples to help your clients with their applications.

In both cases, here are a few resources to help you:

- Internship resume sample: You can use this example as a guide when writing your internship resume. Learn how to create a strong intern resume.

- Academic Resume: Use this academic resume example when creating your next CV.

- Resume examples for students: Use these examples to assist your student clients in enhancing their resumes.

- High School Student Resume: If your student clients are fresh high school grads, these examples would be ideal for them.

Wrapping Up

Using this list of student loan advisor resume examples is your first step toward getting your next advisory role.

Follow the provided examples and customize your resume according to the vacancy you’re applying for. Tailor the resume to highlight your unique skills and relevant competencies.

Because every word in your resume should count, use the most suitable action verbs to emphasize your skills and experience.

Leave a comment below with your questions or thoughts, and share this article with someone interested in getting a student loan advisory job.