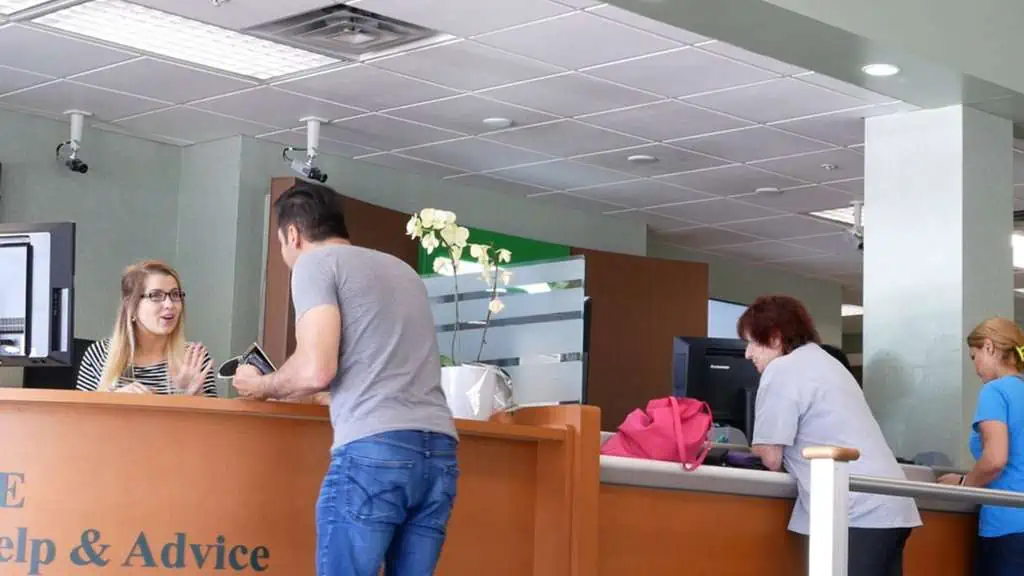

You want weekends and federal holidays off, but you don’t want to go work for a massive company in a huge office.

So you look at becoming a bank teller, where you’ll have a great schedule but a smaller workplace due to the branch setup.

No one can blame you for wanting a traditional schedule or for wanting to know all of your coworkers. But to make this dream a reality, you’ll have to examine a bank teller’s resume or two.

Keep reading for some top-tier resumes for entry-level through managerial roles. That way, you’ll know what to put in your resume when applying.

Bank Teller Resume Examples

As a bank teller, you get to meet new people every day and learn valuable skills.

Whether being a bank teller is your end career goal or a stepping stone, you should know what a resume should look like when applying for this job.

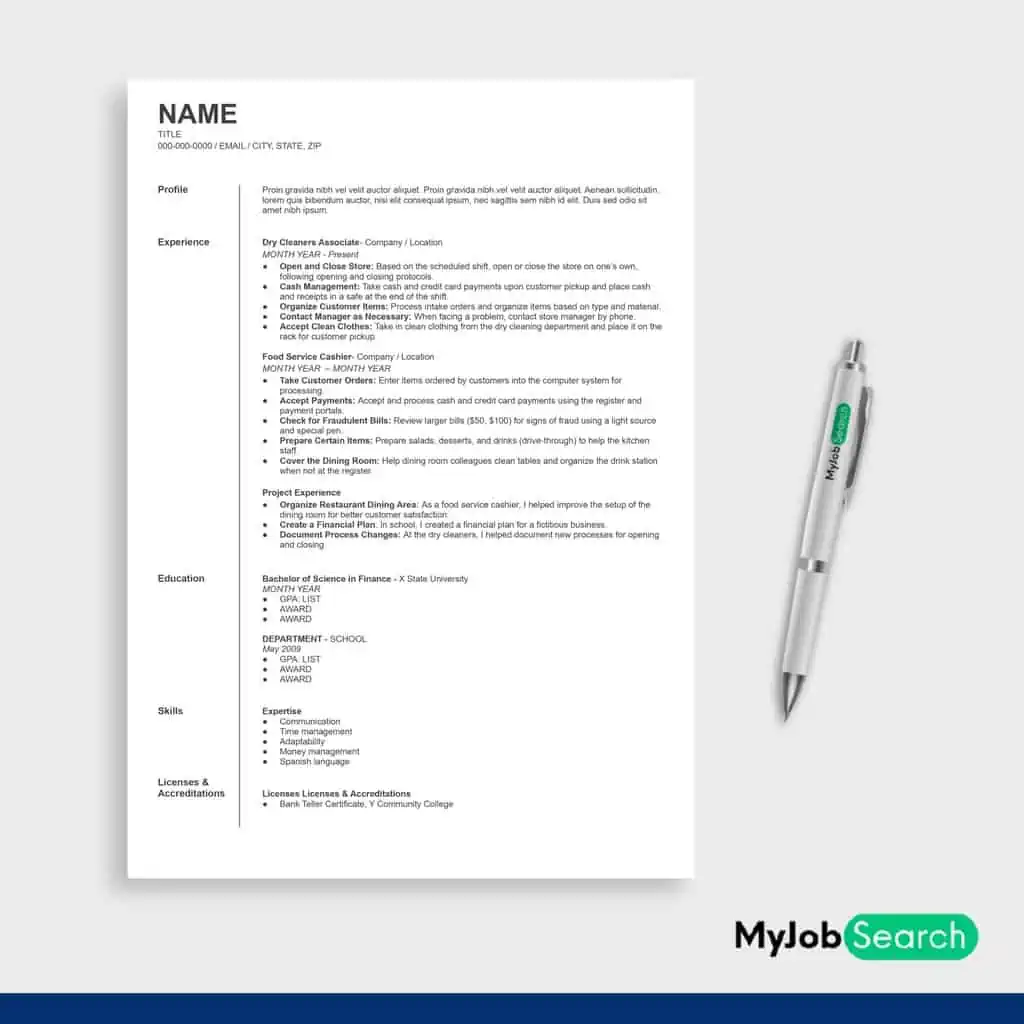

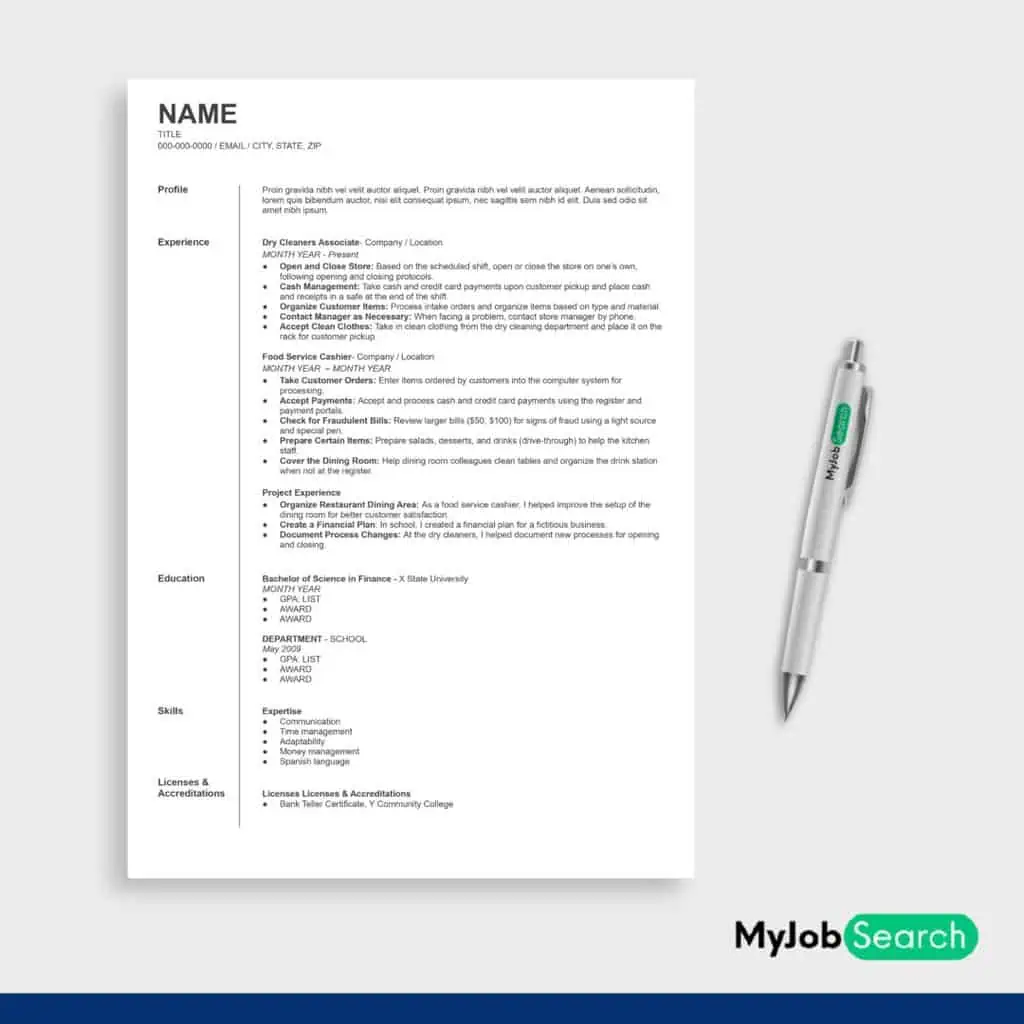

Entry-Level Bank Teller Resume Example

Don’t let a lack of industry experience keep you from working in a bank. Use the experience you do have to write a compelling resume to help get yourself an interview. Then, you can use the interview to share why you’re the best person for the job.

Why We Suggest this Resume

This resume highlights relatable skills from other jobs to match the bank teller job description. This makes it suitable for someone with no bank experience.

- Type of Resume: Entry-Level Bank Teller Resume Example

- Best For: Fresh graduates looking for entry-level jobs in the banking industry

Work Experience 1: Dry Cleaners Associate

- Open and Close Store: Based on the scheduled shift, open or close the store on one’s own, following opening and closing protocols.

- Cash Management: Take cash and credit card payments upon customer pickup and place cash and receipts in a safe at the end of the shift.

- Organize Customer Items: Process intake orders and organize items based on type and material.

- Contact Manager as Necessary: When facing a problem, contact store manager by phone.

- Accept Clean Clothes: Take in clean clothing from the dry cleaning department and place it on the rack for customer pickup.

Work Experience 2: Food Service Cashier

- Take Customer Orders: Enter items ordered by customers into the computer system for processing.

- Accept Payments: Accept and process cash and credit card payments using the register and payment portals.

- Check for Fraudulent Bills: Review larger bills ($50, $100) for signs of fraud using a light source and special pen.

- Prepare Certain Items: Prepare salads, desserts, and drinks (drive-through) to help the kitchen staff.

- Cover the Dining Room: Help dining room colleagues clean tables and organize the drink station when not at the register.

Project Experience

- Organize Restaurant Dining Area: As a food service cashier, I helped improve the setup of the dining room for better customer satisfaction.

- Create a Financial Plan: In school, I created a financial plan for a fictitious business.

- Document Process Changes: At the dry cleaners, I helped document new processes for opening and closing.

Skills

- Communication

- Time management

- Adaptability

- Money management

- Spanish language

Education

- Bachelor of Science in Finance, X State University

Licenses & Accreditations

- Bank Teller Certificate, Y Community College

Why This Resume Works

This resume highlights two somewhat related job positions. While neither is in the banking industry, both involve working with money to some degree. The resume specifically lists how the candidate worked with cash in their prior roles.

It also shows the applicant’s ability to communicate with management. Meanwhile, the second piece of work experience shows the person’s willingness to help in other areas of the building. Plus, the skills are very relevant, from money management to the more general communication skill.

Next, the resume indicates education in the field of finance. And the applicant also obtained special certification to work as a bank teller. Modeling your resume after this one is an excellent option if you’re new to banking but have some relevant experience.

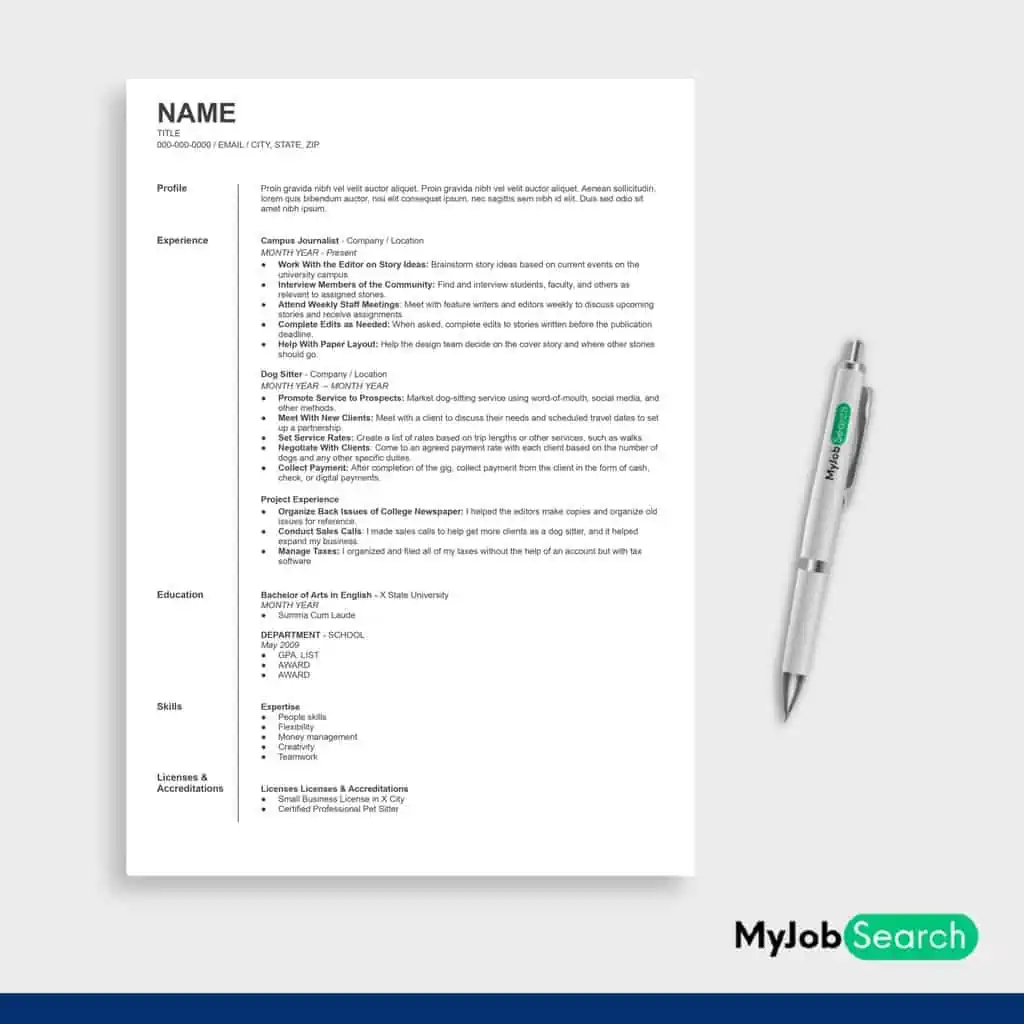

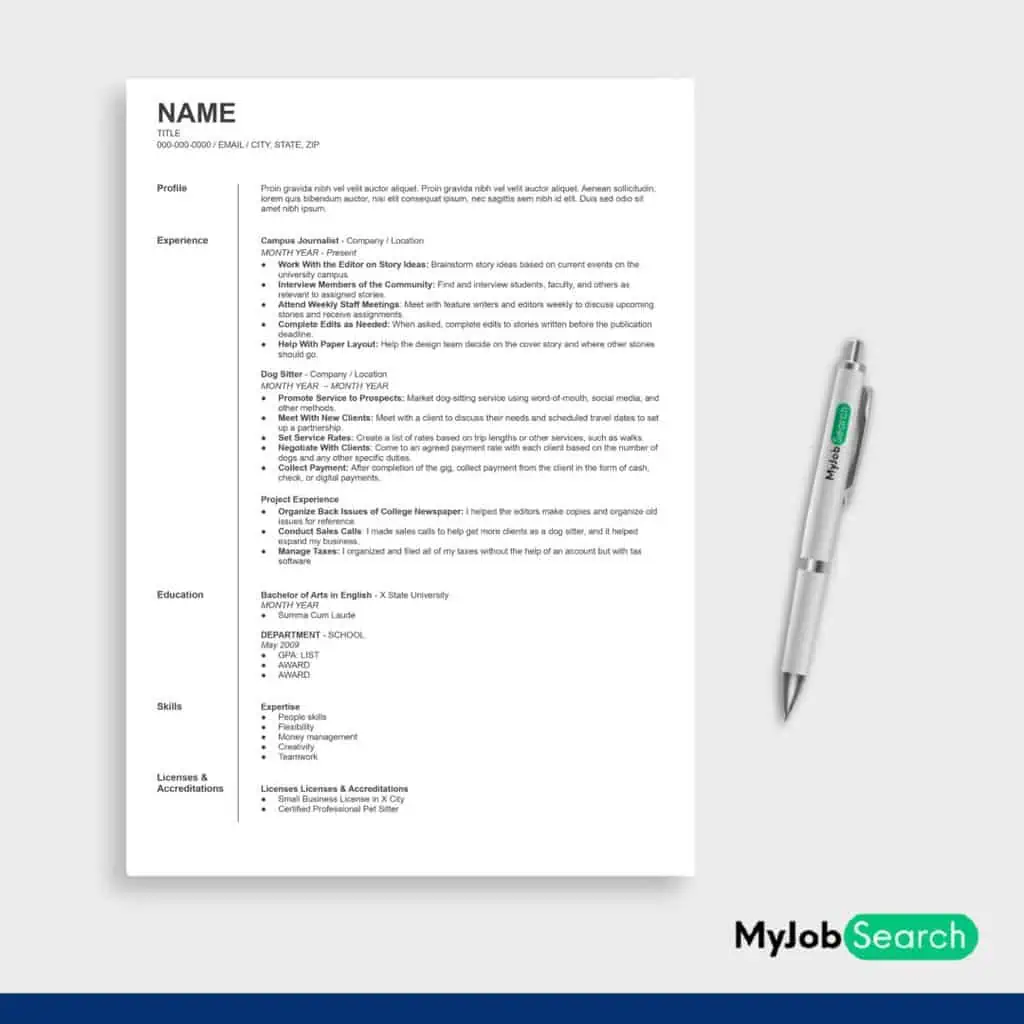

Bank Teller With No Experience Resume Example

Not only may you be new to banking, but you might be new to the working world.

Fortunately, you can follow an excellent example when preparing your bank teller job applications.Your lack of experience may actually become your biggest asset.

Why We Suggest this Resume

This resume is suitable for a bank teller with no experience because it highlights relatable skills from school projects and activities. You can customize this resume to match a job description.

- Type of Resume: Bank Teller With No Experience Resume Example

- Best For: Bank tellers with no experience applying for jobs

Work Experience 1: Campus Journalist

- Work With the Editor on Story Ideas: Brainstorm story ideas based on current events on the university campus.

- Interview Members of the Community: Find and interview students, faculty, and others as relevant to assigned stories.

- Attend Weekly Staff Meetings: Meet with feature writers and editors weekly to discuss upcoming stories and receive assignments.

- Complete Edits as Needed: When asked, complete edits to stories written before the publication deadline.

- Help With Paper Layout: Help the design team decide on the cover story and where other stories should go.

Work Experience 2: Dog Sitter

- Promote Service to Prospects: Market dog-sitting service using word-of-mouth, social media, and other methods.

- Meet With New Clients: Meet with a client to discuss their needs and scheduled travel dates to set up a partnership.

- Set Service Rates: Create a list of rates based on trip lengths or other services, such as walks.

- Negotiate With Clients: Come to an agreed payment rate with each client based on the number of dogs and any other specific duties.

- Collect Payment: After completion of the gig, collect payment from the client in the form of cash, check, or digital payments.

Project Experience

- Organize Back Issues of College Newspaper: I helped the editors make copies and organize old issues for reference.

- Conduct Sales Calls: I made sales calls to help get more clients as a dog sitter, and it helped expand my business.

- Manage Taxes: I organized and filed all of my taxes without the help of an account but with tax software.

Skills

- People skills

- Flexibility

- Money management

- Creativity

- Teamwork

Education

- Bachelor of Arts in English Summa Cum Laude, X State University

Licenses & Accreditations

- Small Business License in X City

- Certified Professional Pet Sitter

Why This Resume Works

While this applicant doesn’t have any experience relevant to banking, they make the most of their existing work experience. For the journalism role, they share the duties that involve working with others, a common facet of a bank teller’s position.

They did the same when listing duties as a dog sitter. Additionally, the dog sitter experience showcases how the candidate was able to manage money. Meanwhile, the project section revolves around the organization, sales, and money.

While the licenses and accreditations aren’t related to banking, they show the job seeker is willing to learn and obtain such certifications. Model your resume after this example if you have no work experience or if your prior jobs had little to do with finance.

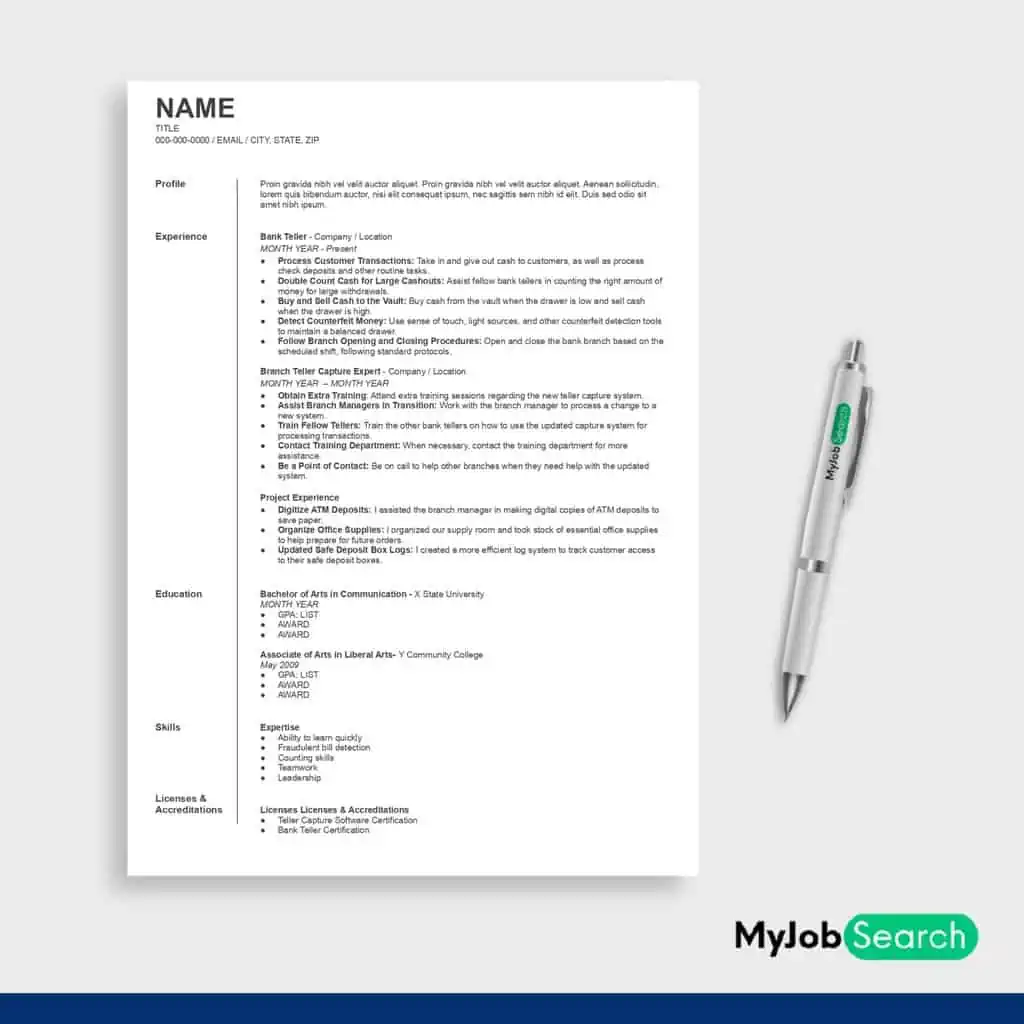

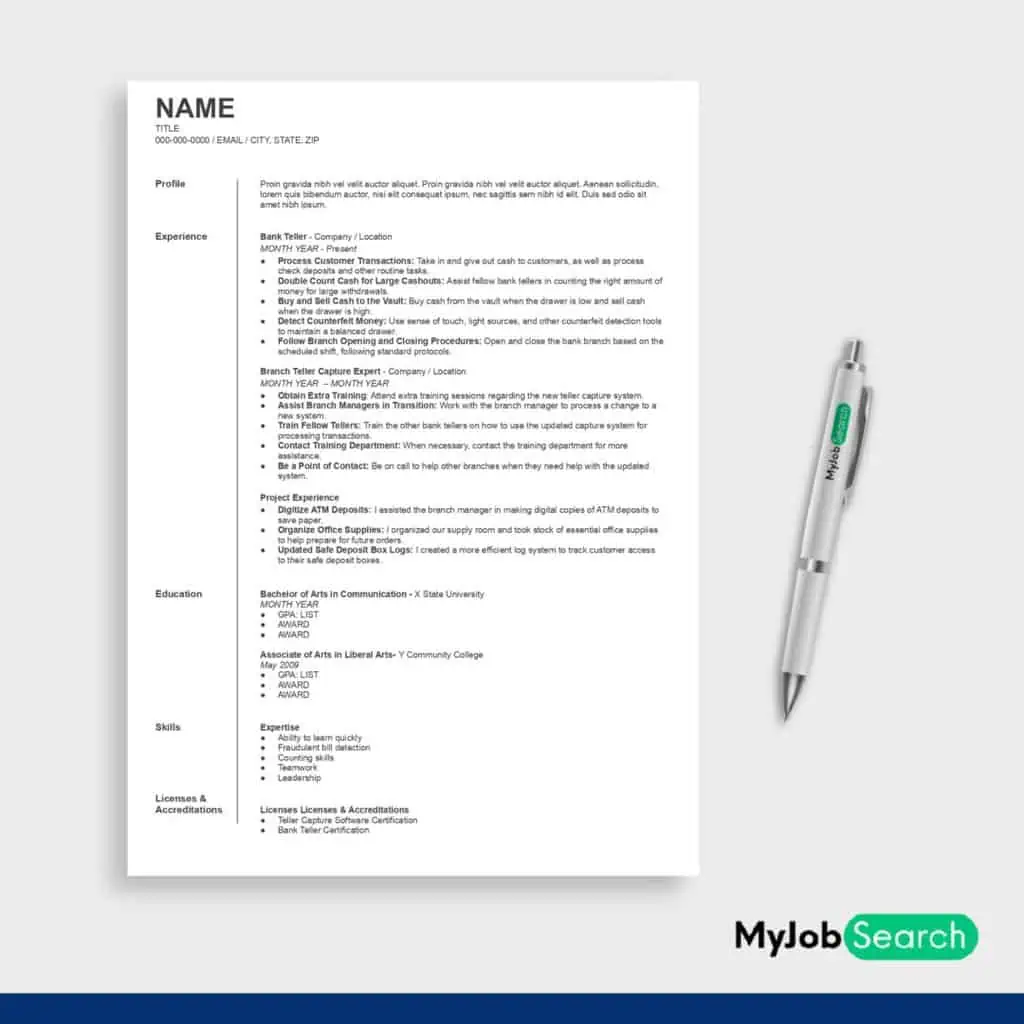

Head Bank Teller Resume Example

You’ve worked as a bank teller for a while, and you enjoy it. But you’re tired of the low pay and are interested in taking on more responsibilities.

Before you apply for a promotion, you should review how your resume needs to look.

Why We Suggest this Resume

This resume works because it shows the applicant’s career trajectory. It starts with the more recent post of vault teller, a similar position to head teller. You can customize this resume according to your work experience

- Type of Resume: Bank Teller Manager Resume Example

- Best For: Bank tellers with several years of experience applying for a managerial role

Work Experience 1: Bank Teller

- Process Customer Transactions: Take in and give out cash to customers, as well as process check deposits and other routine tasks.

- Double Count Cash for Large Cashouts: Assist fellow bank tellers in counting the right amount of money for large withdrawals.

- Buy and Sell Cash to the Vault: Buy cash from the vault when the drawer is low and sell cash when the drawer is high.

- Detect Counterfeit Money: Use sense of touch, light sources, and other counterfeit detection tools to maintain a balanced drawer.

- Follow Branch Opening and Closing Procedures: Open and close the bank branch based on the scheduled shift, following standard protocols.

Work Experience 2: Branch Teller Capture Expert

- Obtain Extra Training: Attend extra training sessions regarding the new teller capture system.

- Assist Branch Managers in Transition: Work with the branch manager to process a change to a new system.

- Train Fellow Tellers: Train the other bank tellers on how to use the updated capture system for processing transactions.

- Contact Training Department: When necessary, contact the training department for more assistance.

- Be a Point of Contact: Be on call to help other branches when they need help with the updated system.

Project Experience

- Digitize ATM Deposits: I assisted the branch manager in making digital copies of ATM deposits to save paper.

- Organize Office Supplies: I organized our supply room and took stock of essential office supplies to help prepare for future orders.

- Updated Safe Deposit Box Logs: I created a more efficient log system to track customer access to their safe deposit boxes.

Skills

- Ability to learn quickly

- Fraudulent bill detection

- Counting skills

- Teamwork

- Leadership

Education

- Bachelor of Arts in Communication, X State University

- Associate of Arts in Liberal Arts, Y Community College

Licenses & Accreditations

- Teller Capture Software Certification

- Bank Teller Certification

Why This Resume Works

Becoming a head teller or vault teller often requires bank teller experience. This resume highlights exactly that. The first job focuses on working as a regular bank teller and includes standard duties.

While it may not be a separate position, the second listing shares a temporary position of teller capture expert. This position was given to help the branch switch to a new processing system, and the chosen applicant helped their branch with the transition.

Of course, the various projects and certifications are directly related to the banking industry. The skills are also tailored to those expected of a head teller. If you’re looking for a promotion, use this example bank teller resume as a model.

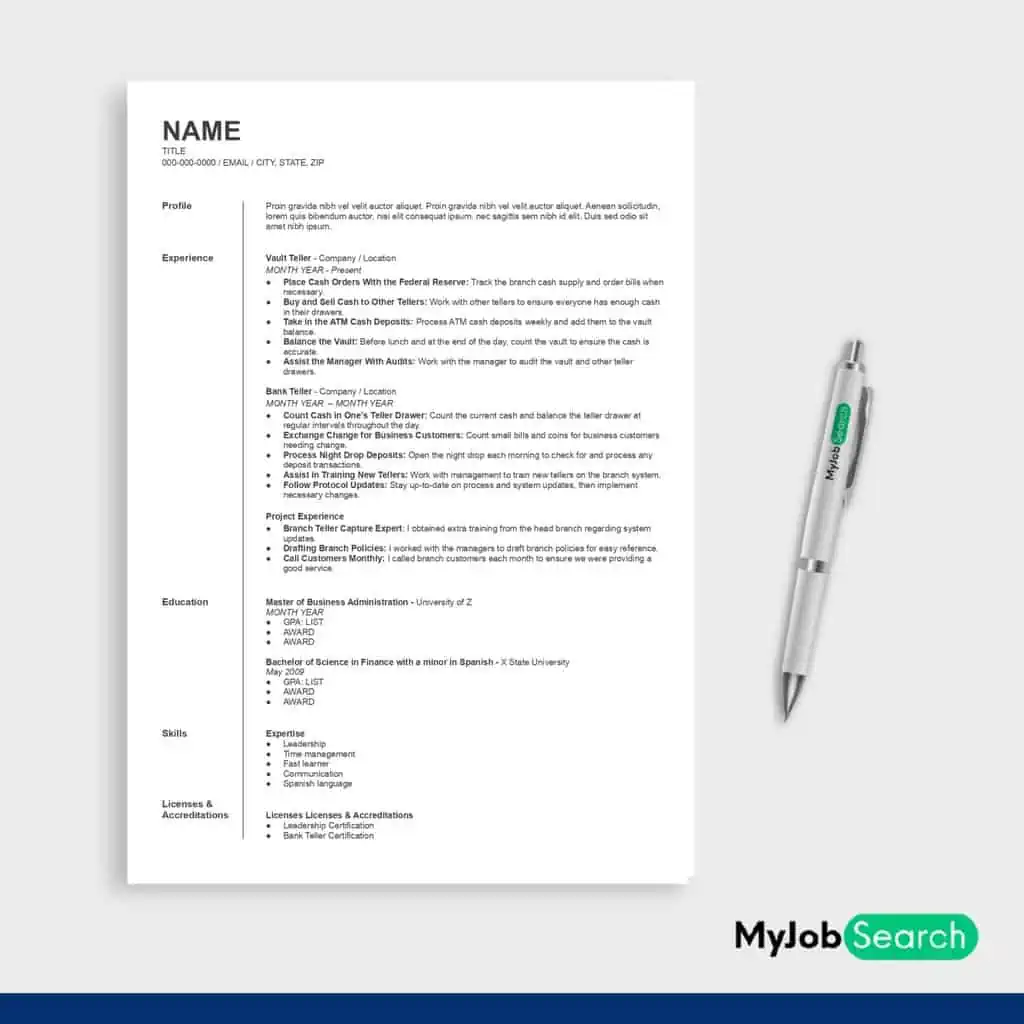

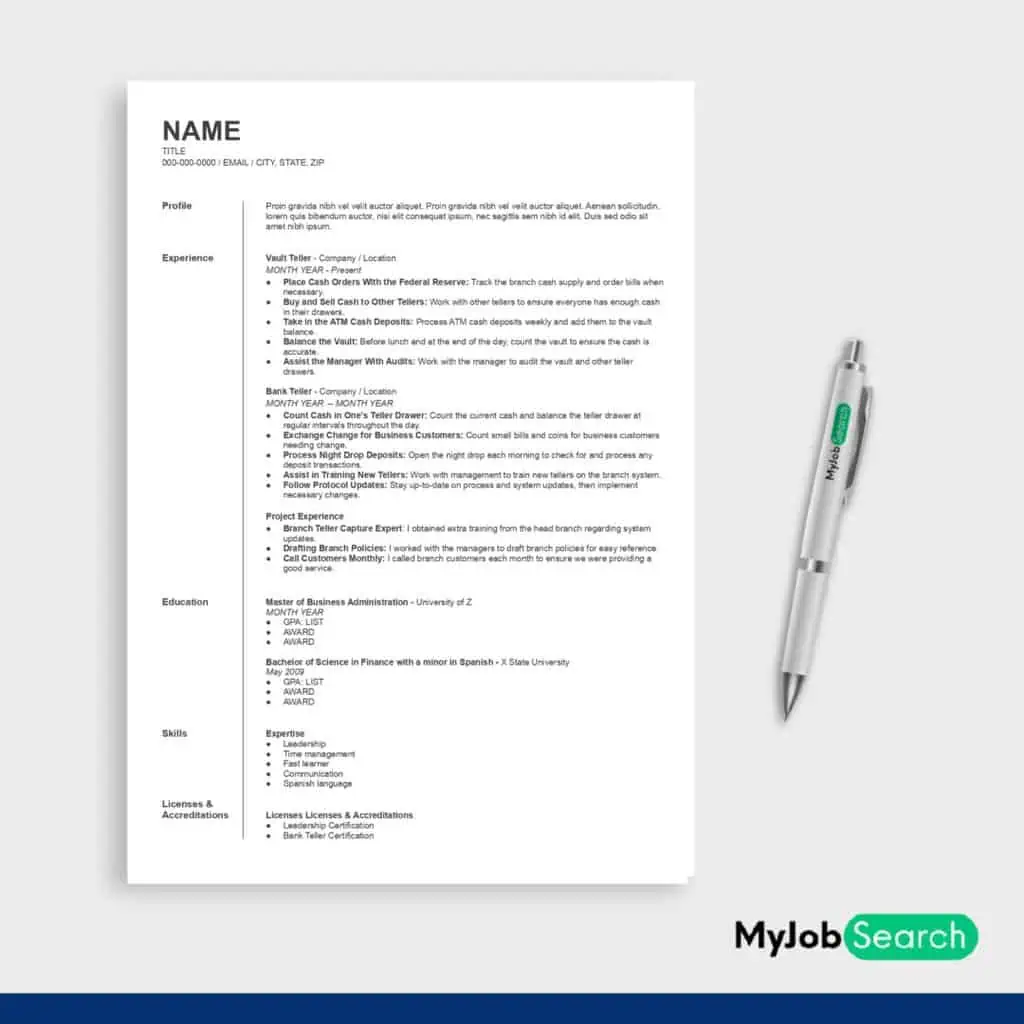

Bank Teller Manager Resume Example

Are you bored of simply working as a teller? Continue your career by applying to work as a teller manager.

However, don’t forget to review some example resumes to make sure yours stands out. From work experience to projects, highlighting your skills is vital.

Why We Suggest this Resume

Becoming a head teller or vault teller often requires bank teller experience. This resume highlights exactly that. You can use this resume to customize it according to your experience.

- Type of Resume: Head Bank Teller Resume Example

- Best For: Bank tellers with several years of experience applying for head bank teller jobs

Work Experience 1: Vault Teller

- Place Cash Orders With the Federal Reserve: Track the branch cash supply and order bills when necessary.

- Buy and Sell Cash to Other Tellers: Work with other tellers to ensure everyone has enough cash in their drawers.

- Take in the ATM Cash Deposits: Process ATM cash deposits weekly and add them to the vault balance.

- Balance the Vault: Before lunch and at the end of the day, count the vault to ensure the cash is accurate.

- Assist the Manager With Audits: Work with the manager to audit the vault and other teller drawers.

Work Experience 2: Bank Teller

- Count Cash in One’s Teller Drawer: Count the current cash and balance the teller drawer at regular intervals throughout the day.

- Exchange Change for Business Customers: Count small bills and coins for business customers needing change.

- Process Night Drop Deposits: Open the night drop each morning to check for and process any deposit transactions.

- Assist in Training New Tellers: Work with management to train new tellers on the branch system.

- Follow Protocol Updates: Stay up-to-date on process and system updates, then implement necessary changes.

Project Experience

- Branch Teller Capture Expert: I obtained extra training from the head branch regarding system updates.

- Drafting Branch Policies: I worked with the managers to draft branch policies for easy reference.

- Call Customers Monthly: I called branch customers each month to ensure we were providing a good service.

Skills

- Leadership

- Time management

- Fast learner

- Communication

- Spanish language

Education

- Master of Business Administration, University of Z

- Bachelor of Science in Finance with a minor in Spanish, X State University

Licenses & Accreditations

- Leadership Certification

- Bank Teller Certification

Why This Resume Works

This resume works because it shows the applicant’s career trajectory. It starts with the more recent post of vault teller, a similar position to head teller. The listing shares specific duties from that role.

Meanwhile, the other position is that of an entry-level bank teller. Once again, the listing highlights relevant tasks that helped the candidate get to where they are. The skills and education sections also focus on a background in finance and communication.

In this resume, the projects are also specific, and they’re reminiscent of what a manager may do or assign to their team. Use this example as a model if you’re looking to become a teller, supervisor, or manager.

Describe why this resume works. If somebody is looking at this resume thinking about whether or not they should model theirs after it, why would that be?

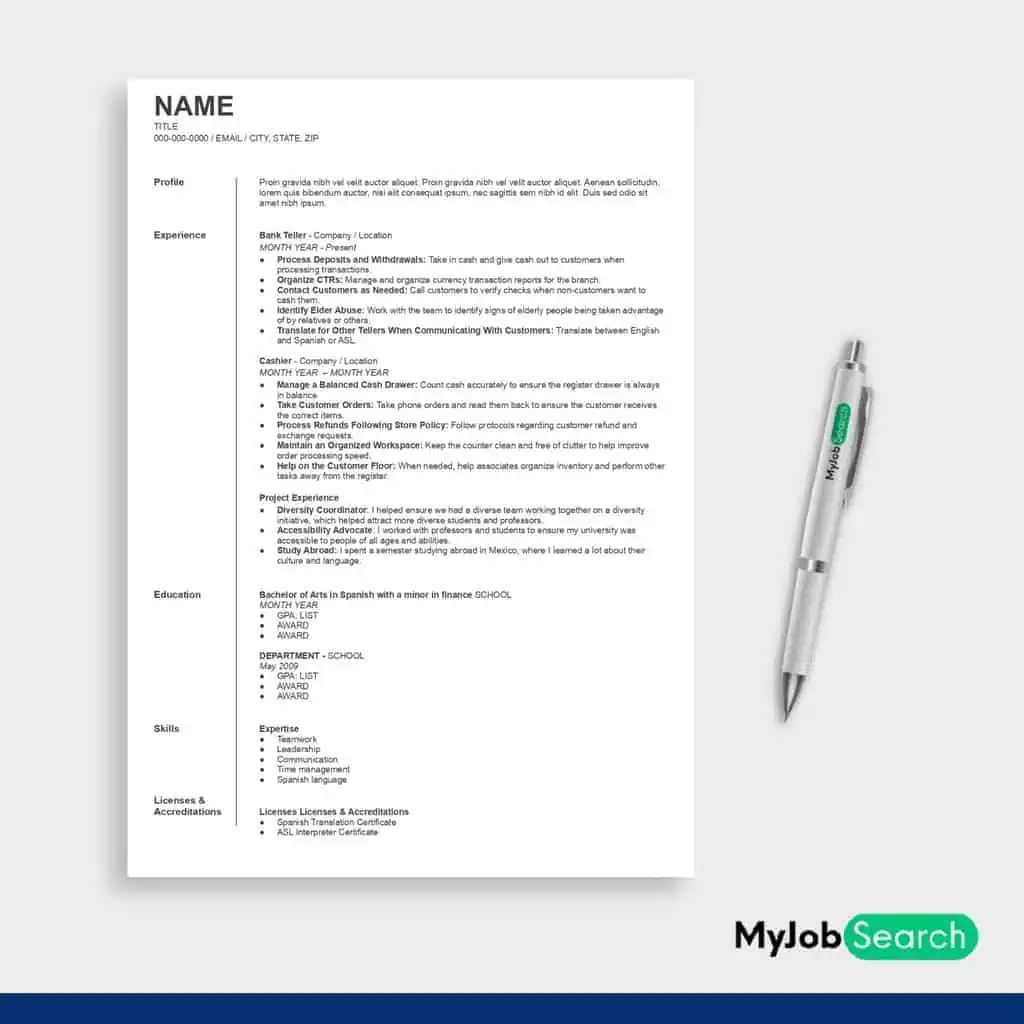

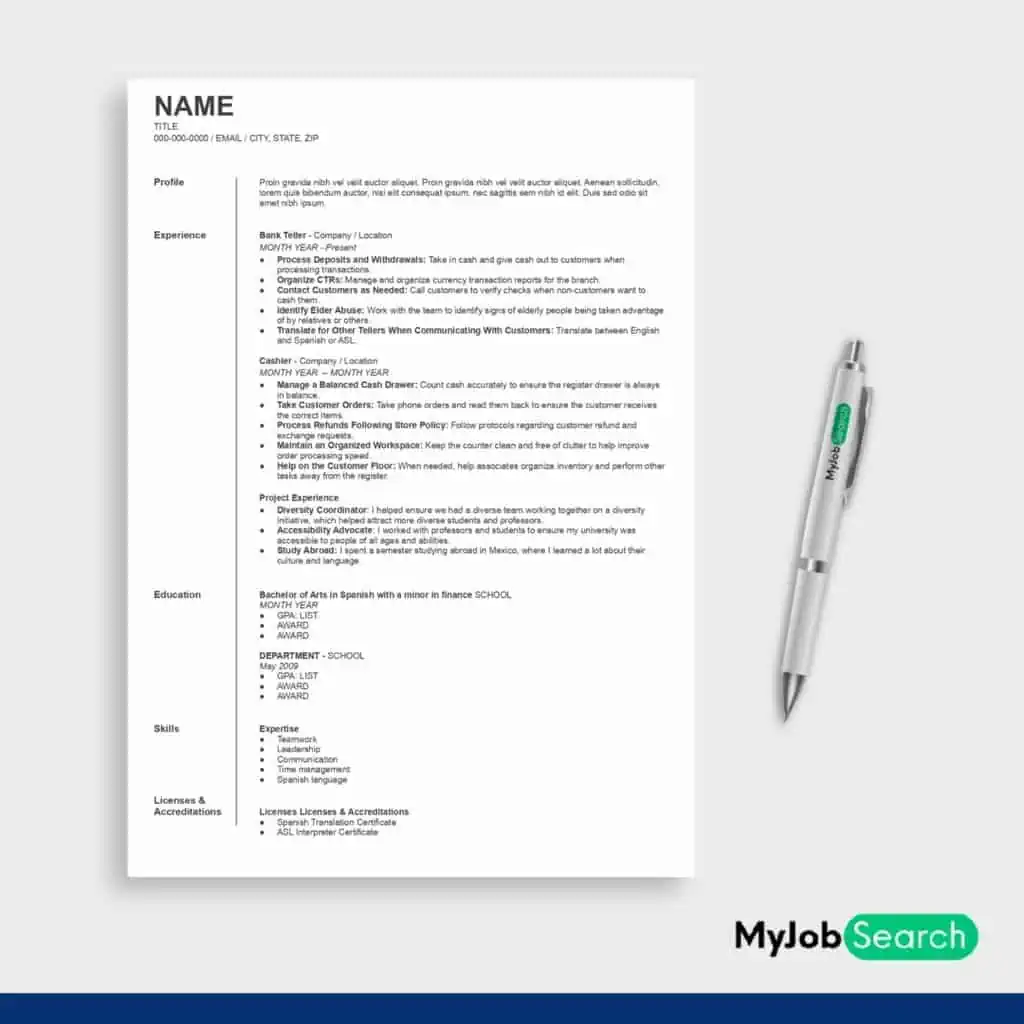

Wells Fargo Bank Teller Resume Example

One of the largest banks in the US, working for Wells Fargo may be a dream of yours. If so, you’ll need to put together a resume that meets the needs of the specific bank.

The more you know about Wells Fargo, the more you can tailor your resume for the job.

Work Experience 1: Bank Teller

- Process Deposits and Withdrawals: Take in cash and give cash out to customers when processing transactions.

- Organize CTRs: Manage and organize currency transaction reports for the branch.

- Contact Customers as Needed: Call customers to verify checks when non-customers want to cash them.

- Identify Elder Abuse: Work with the team to identify signs of elderly people being taken advantage of by relatives or others.

- Translate for Other Tellers When Communicating With Customers: Translate between English and Spanish or ASL.

Work Experience 2: Cashier

- Manage a Balanced Cash Drawer: Count cash accurately to ensure the register drawer is always in balance.

- Take Customer Orders: Take phone orders and read them back to ensure the customer receives the correct items.

- Process Refunds Following Store Policy: Follow protocols regarding customer refund and exchange requests.

- Maintain an Organized Workspace: Keep the counter clean and free of clutter to help improve order processing speed.

- Help on the Customer Floor: When needed, help associates organize inventory and perform other tasks away from the register.

Project Experience

- Diversity Coordinator: I helped ensure we had a diverse team working together on a diversity initiative, which helped attract more diverse students and professors.

- Accessibility Advocate: I worked with professors and students to ensure my university was accessible to people of all ages and abilities.

- Study Abroad: I spent a semester studying abroad in Mexico, where I learned a lot about their culture and language.

Skills

- Teamwork

- Leadership

- Communication

- Time management

- Spanish language

Education

- Bachelor of Arts in Spanish with a minor in finance

Licenses & Accreditations

- Spanish Translation Certificate

- ASL Interpreter Certificate

Why This Resume Works

Wells Fargo has begun to prioritize diversity and accessibility. This resume highlights how the applicant is passionate about those things. It specifies how the person has worked on these things in projects and as a bank teller at another institution.

While a cashier position isn’t in the banking industry, the listing showcases the duties that had the most to do with money management and teamwork. Those skills will come in handy as a teller for Wells Fargo and any bank.

Meanwhile, the skills and accreditation sections focus on communication and accessibility by way of various languages. If you know another language, mention it, especially considering Wells Fargo offers international jobs. Use this example as a model, and adapt it to any other specific bank you want to work for.

Common Skills & Action Verbs To Include on a Bank Teller Resume

Give your resume an extra splash of personality with the right skills and verbs. Resumes with boring wording often won’t make it past resume review software. That means you need to get creative with how you write job descriptions and list your skills.

Of course, you may want to share that you have communication skills. However, consider sharing that in a unique way. For example, you might say you “facilitated communication between branches to ensure smooth operations for the entire bank.”

Using the right action verbs is also vital for getting past resume sensors. These verbs show you took an active approach in your latest job. Plus, you don’t need bank teller experience to use these verbs.

Common Skills for Bank Teller Resumes

- Cash handling

- Mental math

- Teamwork

- Attention to detail

- Honesty and integrity

- Typing

- Conflict resolution

- Problem-solving

- Office phone use

- Data entry

- Communication

- Transaction processing

- Ability to learn fast

- Flexibility

- Project management

- Time management

- Organization

- Fraud detection

- Empathy

- Email communication

Common Action Verbs for Bank Teller Resumes

- Accepted

- Advised

- Improved

- Assisted

- Conducted

- Maintained

- Ensured

- Oversaw

- Reduced

- Managed

- Trained

- Processed

- Contacted

- Coordinated

- Controlled

Tips for Writing a Better Bank Teller Resume

Picture yourself as the hiring manager for a bank. You receive two resumes that are very similar, but one is much more intriguing than the other.

Despite both candidates having nearly identical backgrounds, one is the clear winner.

Now you’re you again. Follow a few vital tips so that your resume doesn’t get left in the dust.

1. Tailor the Resume to the Job

Resist the temptation to send out the same resume to dozens of banks. Instead, take the time to thoughtfully tailor the resume to each bank and position. Do your research on what the bank is looking for in a teller so that you can include those details in your resume.

For example, Wells Fargo cares about diversity. Share jobs and projects where you got to work as part of a diverse team or where you implemented diversity in your workplace.

Review the bank’s website, social media, and employer profiles. Learn what current and former employers have to say about the company. Then, organize each resume into a resume folder so that you can easily find it when applying for jobs.

2. Include More of Your Accomplishments

Maybe you don’t have any experience working for a bank. Not only can you include work experience in other industries, but you can share more things you’ve done. When listing your work experience, share duties that would help you as a teller.

Focus on projects or skills that are related to money and working with the public. You may also want to consider listing awards you’ve won, especially if they have to do with leadership or time management.

Whether it’s a job or a project, prioritize relevant experience and accomplishments. The last thing you want to do is bore the hiring manager with multiple pages of irrelevant things. Put yourself in their shoes and consider what you’d want to know.

3. Compare Others’ Resumes

If possible, review resumes from successful bank tellers. Many people are putting resumes on LinkedIn, so it’s an amazing place to find more specific examples. Look for tellers who work at the bank of your dreams.

Find their profiles and review their resumes if they’re available. If not, you can send the person a message asking how they got the job and if they’ll send you a copy. Now, that doesn’t mean you have permission to copy someone’s resume.

Working as a bank teller requires you to be honest, so you don’t want to give off a bad first impression. However, other resumes can serve as inspiration. Then, you can make sure you do the best job on your own resume.

4. Keep It Simple

You’re not applying to work for BuzzFeed or New York Fashion Week. This is not the time to get creative with the layout or other design features. Instead, keep it simple and clean so that it’s easy to read.

Use headers and bullets to help format the resume to help the hiring manager scan it. Make sure the font isn’t too small or too large. And keep it so that black is the only ink color, which is easier for printing and more professional.

When choosing fonts, use something standard, like Arial or Times New Roman. Avoid curly fonts that are impossible to read at the necessary font size.

Frequently Asked Questions

Before you send out a bunch of bank teller resumes, you may still have questions. Read on for the answers you’re looking for.

Will a bank hire me with no experience?

Some banks will hire tellers with no experience.

Even if it’s your first bank teller job, you may need other customer service or cashier experience.

You’ll also want to use your resume to show how the experience you have can help you succeed in the job.

What is a good example of a bank teller’s resume objective?

The best bank teller resume objective can vary from bank to bank.

As you research the company, figure out what they’re looking for.

Then, you can write how you’ll fill that need and how you can do so as a teller.

Similar Resume Types To Reference

Not sure if you want to work as a bank teller?

Review these other types of resumes to help land your ideal job, whether that’s at a bank or another business.

- Cashier Resume: A cashier’s resume should focus on customer service and cash handling, similar to a bank teller’s resume.

- Federal Resume: Consider what goes on a federal resume, especially if you may want to work for the Federal Reserve or another government agency.

- Accounting Resume: Accountants need experience handling money and working with numbers, and their resume must showcase those skills and abilities.

Wrapping Up

Working as a bank teller is one of the most chill jobs you could get. Not only do you get most weekends and holidays off, but the workload isn’t that stressful.

However, if you want to land a job, you’ll need to apply with an exquisite bank teller resume. Be sure you review some examples to help inspire you.

Soon enough, you’ll find yourself landing interviews and getting a job offer you can’t turn down. If you have any thoughts on this topic, leave them in the comments.